Buy to Let Mortgages to rent to family members rules - Information on Regulated Buy to Let Mortgages If you want to buy a house and rent it to a family member such as your children (aged over 18 years), father, mother, brother sister, aunt and … [Read more...] about Changes to the Family Buy to Let Mortgage product in the UK

Mortgages

Mortgage and product news, best buys and tips

Mortgage Conveyancing explained

What does a Mortgage conveyancer /solicitor do when a property is purchased and how does this effect my house purchase chances? My role as a Mortgage Broker is to obtain finance to purchase a property requires me to keep you updated until the … [Read more...] about Mortgage Conveyancing explained

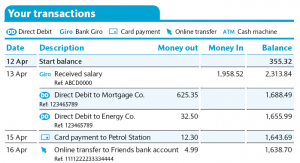

What do mortgage lenders look for in your bank statements?

If you are applying for a mortgage then the chances are the lender will want to see your bank statements, but why are these relevant? … [Read more...] about What do mortgage lenders look for in your bank statements?

Top 10 Mortgage valuation problems

Mortgage valuation problems & what property defects are mortgage lenders looking for in their valuation? When you are arranging a mortgage the lender will carry out a basic mortgage valuation. This article covers the Top 10 Mortgage … [Read more...] about Top 10 Mortgage valuation problems

Mortgage with a criminal record

Tips on getting a Mortgage with a criminal record and how to source the right mortgage in the UK if you have been to prison. I am a firm believer that people who have paid their price should always be given a second chance. Unfortunately this may … [Read more...] about Mortgage with a criminal record

Why its time to Remortgage to a fixed rate

5 year Fixed Mortgage rates from 2.44% maybe its time to Remortgage to a fixed rate now In recent years remortgages have not been as popular as they once were as rates have been so low, however both the Chancellor and Governor of the Bank of England … [Read more...] about Why its time to Remortgage to a fixed rate

Buy to let Mortgage Limited Companies

Key points on Buy to let Mortgage Limited Companies and how the finance side of things work Following the budget landlords have been turning to limited company wrappers for their portfolios but is there only an upside? Moving assets out of an … [Read more...] about Buy to let Mortgage Limited Companies

Deposit levels needed to get a Mortgage with a default

Your guide on getting a Mortgage with a Default. Read below about how much deposit you need and what are the maximum limits on past defaults. The good news is I specialist in mortgages for customers with defaults on their credit file. The bad … [Read more...] about Deposit levels needed to get a Mortgage with a default

Deposit levels needed to get a Mortgage with a CCJ

How much deposit do I need to get a Mortgage with a CCJ This article is about obtaining mortgage finance if you have a county court judgement (ccj). It is aimed at residential mortgage customers who want a conventional mortgage; it is not open to … [Read more...] about Deposit levels needed to get a Mortgage with a CCJ

Mortgage with bad credit Update July 2015

Getting a Mortgage with Bad credit including CCJs, Default, Missed payment and debt management plans. Residential and Buy to Let Mortgages with Bad Credit Missed payments on loans and Credit cards County Court Judgements (CCjs) And … [Read more...] about Mortgage with bad credit Update July 2015