You should take out an Home buyer or full structural survey or you could be in a lot of trouble.

If you are in the process of buying a home, I don’t need to tell you that it’s a costly business. However, the outlay could pale into insignificance if, once the property is purchased, there are unexpected essential repairs needed.

That is why we always recommend that if you are serious about buying a property, you consider obtaining your own survey, as this can pre-empt any trouble ahead and also allow you to haggle on the purchase price.

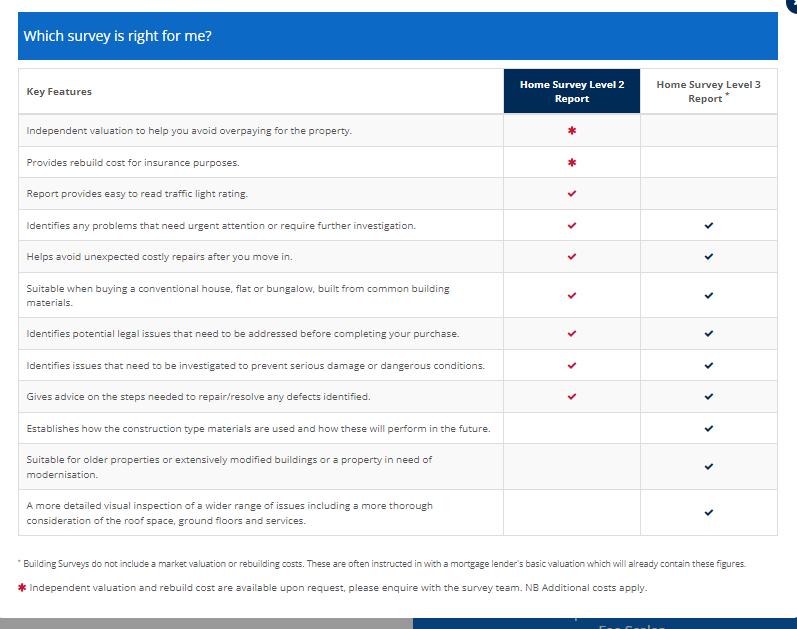

There are 3 types of Property Valuation, which are explained in detail below. The Lender’s Basic Property Valuation is required on all mortgage cases. However, if you want to find out more about the property, we highly recommend that you consider either a Homebuyer’s Report or a Building Survey.

Lender’s Basic Property Valuation

This is a brief report that includes our assessment of the property’s value. It highlights any major defects or legal issues that might affect the property’s value, but it is not a survey of the property.

It is designed for the Lender’s purposes.

If you are purchasing a previously occupied property or a newly built property, it is our recommendation that you seriously consider a product that provides an assessment of both the property’s condition and value.

Homebuyer’s Report Level 2 – Property Check

This is an intermediate level of report. As well as providing assessment of the value of the property the valuer will carry out a survey on the property and report on its condition. The report provides an outline of the condition of the property on the day of inspection and also highlights the urgency of repairs.

A Homebuyer’s Report is ideal when you’re buying a previously occupied property or a new build property as the surveyor carries out an internal and external inspection, giving you more information on the condition of the property. This helps you gauge whether the purchase price is fair and also gives you an insight into what work will need to be carried out and the property’s re-saleability.

Home Survey Level 3

The surveyor will make a thorough internal inspection of the property.

The exterior inspection includes a visual check of accessible parts of roofs and drains on the property. It will identify any structural movement and evidence of major problems.

Among the key advantages of a Building Survey is that it gives you a detailed analysis of a property’s construction. It also gives you an assessment of essential repairs including the likely repair cost and a recommendation on how the repair should be carried out.

If you’re about to buy a large home or have specific concerns about the property, then this type of survey would be appropriate.

Home Survey / Valuation Costs

Below is a list of what some of the main lenders charge for the different version of the Home Survey / Valuations. If your lender is not on the list please do let us know during the application process so we can obtain you a quote.

PLEASE MAKE SURE THAT THE DOCUMENTS OR PAGES ARE UP TO DATE AS LENDERS CHANGE THESE OFTEN WITHOUT ANY NOTICE.

ACCORD MORTGAGES

http://www.accordmortgages.com/literature-information/fees-charges/

ALDERMORE BANK FOR INTERMEDIARIES

http://www.aldermore.co.uk/intermediaries/residential-mortgages/literature-downloads/

BM SOLUTIONS

http://www.bmsolutions.co.uk/criteria/fees/

FLEET MORTGAGES

https://www.fleetmortgages.co.uk/wp-content/uploads/2018/04/Tariff-of-Mortgage-Charges-Version-4.pdf

FOUNDATION

https://www.foundationforintermediaries.co.uk/useful-information/fees-overview/

HALIFAX

https://www.halifax-intermediaries.co.uk/products/mortgages/valuation_fees/default.aspx

LEEDS BS

http://www.leedsbuildingsociety.co.uk/intermediaries/charges-and-valuation-fees/

MASTHAVEN

https://www.masthaven.co.uk/MasthavenBank/media/broker-resource/tariff-of-charges.pdf

NATWEST

http://www.intermediary.natwest.com/intermediary-solutions/lending-criteria.html

NEWCASTLE

http://www.newcastleis.co.uk/docs/summary-of-fees.pdf

PARAGON

PLATFORM

http://www.platform.co.uk/pdf/platform-tariff-of-charges-may18.pdf

PRECISE

https://www.precisemortgages.co.uk/Residential/Fees

PEPPER MONEY

https://www.peppergroup.co.uk/siteassets/lending/pdfs/tariff-of-charges2.pdf

PRINCIPALITY

http://www.principality.co.uk/en/PBS/Intermediaries/Useful-Documents

SANTANDER FOR INTERMEDIARIES

https://www.santanderforintermediaries.co.uk/downloads/1085

THE MORTGAGE LENDER

https://www.themortgagelender.com/wp-content/uploads/2018/05/Tariff-of-Charges_May18.pdf

THE MORTGAGE WORKS

http://www.themortgageworks.co.uk/includes/pdf/T21_10_17.pdf

TIPTON & COSELEY

https://www.thetipton.co.uk/our-mortgages/mortgage-valuation-charges/

VIDA HOME LOANS

VIRGIN

https://intermediaries.virginmoney.com/virgin/lending-policy/find-articles-a-z/index.jsp?range=vz

A different scale could apply for Scotland.

Please make sure you double check all fees before full mortgage application as this page is for guidance only.