Can any solicitor or conveyancer help with limited company buy to let mortgages? Please can I start by saying we are not a legal firm but a Mortgage Broker that advises on limited company buy to let mortgages. From my perspective I take the … [Read more...] about Choosing the right Solicitor for your limited company buy to let mortgage

I need a loan or mortgage to pay for my wedding

Borrowing to pay for your wedding Borrowing on a mortgage to pay for a wedding is not the ideal start of a married life but a reality for most. In a 2017 survey featured in The Independent the average cost of a wedding was £27,161 a figure that is … [Read more...] about I need a loan or mortgage to pay for my wedding

Remortgage to convert your Buy to Let into an HMO

Convert your Buy to Let property into an Houses in multiple occupation - HMO You may have been caught out by the reclassification of your property from a multi-let to HMO? As well as the licence itself the upgrade of the property to meet the HMO … [Read more...] about Remortgage to convert your Buy to Let into an HMO

Do I need to get a new mortgage following the HMO licencing changes?

Do I need to get a new mortgage following the HMO licencing changes? When do I have to obtain a HMO licence?Normally you’re obliged to inform your Mortgage Lender of any significant material changes to the property or its tenancy arrangements. For … [Read more...] about Do I need to get a new mortgage following the HMO licencing changes?

Commercial Mortgage for Day Nursery childcare businesses

Getting a Commercial Mortgage for Day Nursery childcare providers in the UK. Obtaining finance can be a daunting but at Niche we can help you access to some great Commercial Mortgages suited for new and existing Nurseries & Nursery School … [Read more...] about Commercial Mortgage for Day Nursery childcare businesses

Should I take the free legal scheme offered by my mortgage provider?

Are free legal products a gimmick? Most of the leading lender's and building society’s offer a free legal basic service on remortgages – but why? The mechanics Firstly, the Conveyancers will not be undertaking their work for love so you ahve to … [Read more...] about Should I take the free legal scheme offered by my mortgage provider?

Mortgage and Property Down Valuation

What can I do if my Mortgage Lender down values my property. How does this property Down Valuation effect my chances of getting a mortgage. Property Down Valuation is infuriating to all concerned if it reduces the amount you can borrow from a … [Read more...] about Mortgage and Property Down Valuation

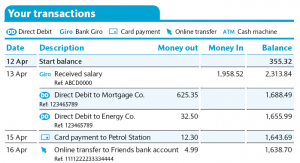

Bank Statements for Mortgage Applications

Best format for gathering your bank statements for Mortgage Applications including how to get statements with https:// on them. In our experience, one of the biggest causes of delay when gathering documentation for mortgage applications is … [Read more...] about Bank Statements for Mortgage Applications

Questions & Answers in regards to the new New Stamp Duty Rules

Questions & Answers in regards to the new New Stamp Duty Rules and how it can impact second homes. Please see table of Stamp Duty rates below, in short if you own more than one house then the second house rate applies unless it is to change … [Read more...] about Questions & Answers in regards to the new New Stamp Duty Rules

What is the Mortgage Credit Directive

What is the Mortgage Credit Directive and how it will impact some Mortgages in the UK In essence this European Legislation has been bought in to raise standards and standardise documentation across the Member States to improve consumer protection … [Read more...] about What is the Mortgage Credit Directive