Maximum Mortgage Affordability Comparison for Residential Mortgages for Single and Joint Persons. In this article, I have worked on Mortgage Affordability Comparison using the research tool MBT, which references over forty-five UK mortgage … [Read more...] about Which UK Bank Offers You The Maximum Mortgage Affordability

News

How to get a Mortgage For a 56 Days Auction – Modern Method of Auction

YES, you can get a Mortgage for a 56 Days Modern Method of Auction Property rather than getting Bridging Finance. Lets look at why we now have the 56 Days Modern Method of Auction. Historically, auction purchases have provided 28 day deadline to … [Read more...] about How to get a Mortgage For a 56 Days Auction – Modern Method of Auction

5% Deposit Mortgages With Visas For Foreign Nationals | Niche

Are you a foreign national looking for mortgage advice in the UK? Learn more about visa mortgages and how to secure a Mortgage with only a 5% deposit. 5% deposit Mortgages with Visas for foreign nationals living and buying in the UK are a real … [Read more...] about 5% Deposit Mortgages With Visas For Foreign Nationals | Niche

How to use your first time buyer status effectively

Protect your first time buyer status First time buyers are the live-blood of the property market and this is recognised with "first time buyer status" afforded benefits from tax incentives to more attractive mortgage products. Therefore it's … [Read more...] about How to use your first time buyer status effectively

1 Year Fix Self Employed Mortgage

Borrow more with this 1 Year Fix Self Employed Mortgage aimed at mortgages over £500,000 Bumper year or just 1 year’s trading – borrow more with this 1 Year Fix Self Employed Mortgage aimed at mortgages over £500,000 … it could be the ideal … [Read more...] about 1 Year Fix Self Employed Mortgage

First Time Buyer 100% Mortgage UK launched by Skipton

Skipton – 100% Mortgage For First Time Buyers Please see below the basis of the First Time Buyer 100% Mortgage UK launched by Skipton Building Society. As it’s hot off the press, it is unclear at the moment as to … [Read more...] about First Time Buyer 100% Mortgage UK launched by Skipton

5 Year Fixed Buy to Let Mortgage with no early repayment charges

Benefits from rental calculations to fit on a 5 Year Fixed Buy to Let Mortgage with no early repayment charges throughout - Best of both worlds I rarely pen about specific products but feel compelled to do so about the Accord Mortgages 5 Year … [Read more...] about 5 Year Fixed Buy to Let Mortgage with no early repayment charges

Best Right to Buy Mortgage Broker Leeds, Yorkshire

Buy your home with advice from expert Right to Buy Mortgage Broker in Leeds and Yorkshire Are you a Right to Buy homebuyer in Leeds, Yorkshire looking for a reliable Right-to-Buy Mortgage Broker in the Burmantofts LS9, Killingbeck & Seacroft … [Read more...] about Best Right to Buy Mortgage Broker Leeds, Yorkshire

A mortgage with Default – Should I pay it off?

Getting a Mortgage with Default on your Credit Report Should I pay off my default to get a mortgage is a question I hear with regularity. I retort “No you should have paid it off in the first place!” – only joking - I appreciate it’s not that … [Read more...] about A mortgage with Default – Should I pay it off?

Best Right to Buy Mortgage Broker in New Addington and CR0 postcode

Niche Advice are based in Vulcan way, New Addington Surrey CRO and can help clients get the best Right to Buy Mortgage. Are you a Right to Buy homebuyer in New Addington, Croydon and Surrey looking for a reliable Right-to-Buy Mortgage Broker in … [Read more...] about Best Right to Buy Mortgage Broker in New Addington and CR0 postcode

My partner has Bad credit can I get a mortgage?

Applying for a Mortgage Yourself When Spouse Has Bad Credit You may be surprised to know that having a spouse with bad credit doesn't mean you can't get a mortgage in a single name. Here's what you need to know. Can your long-term Partner’s … [Read more...] about My partner has Bad credit can I get a mortgage?

Right to Shared Ownership scheme Mortgage

Mortgage for Right to Shared Ownership scheme Calling all Tenants living in social and affordable housing The Right to Shared Ownership scheme is now open. Right to Shared Ownership has opened its door for Tenants living in social and … [Read more...] about Right to Shared Ownership scheme Mortgage

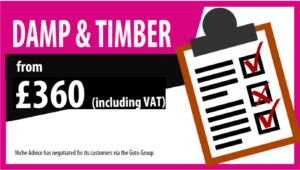

Timber and Damp Report to support mortgage applications

If you are reading this blog, you have probably applied for a mortgage, and the Mortgage Lender has asked for a specialist Timber and Damp Report to support your case. The blog puts into context why a Timber and Damp Report has been asked for by … [Read more...] about Timber and Damp Report to support mortgage applications

Free Mortgage Rate Switch for existing bank customers

No Broker fees for Mortgage Rate Switch with Niche Advice How does the Mortgage Rate Switch Product Transfer process work for the UK Lenders' existing mortgage customers No Broker fees for Mortgage Rate Switch with Niche Advice … [Read more...] about Free Mortgage Rate Switch for existing bank customers

Free BM Midshires Rate Switch Product Transfer Service

Free BM Midshires Rate Switch Existing Customer Service from Niche Advice Birmingham Midshires product transfer service Before the recent rate rises BM Solutions product transfer service to rate switch was not as popular as it is not as … [Read more...] about Free BM Midshires Rate Switch Product Transfer Service