Does the loan to value - LTV product limit a remortgage amount? How to loan to value limits work? You may have seen Lenders quoting loan to value / LTV limits for their remortgages on their websites and literature but what does it all mean? The … [Read more...] about Loan to value LTV limit for a remortgage

News

Borrowing from The Mortgage Works has just got harder

Existing customers who want to raise additional money from The Mortgage Works may face disappointment due to recent rental calculation criteria changes. If you are an existing The Mortgage Works customer you will probably be shocked to find out that … [Read more...] about Borrowing from The Mortgage Works has just got harder

Self Employed Mortgage based on last years accounts

Self Employed Mortgage based on last years accounts - Borrow more when using the last year’s net profit If you need a self employed Mortgage based on last years accounts account then you have come to the right website . It could be me … [Read more...] about Self Employed Mortgage based on last years accounts

The Mortgage Works changes rental calculation and maximum LTV for the worse

Bad news as one of the UK’s largest Buy to Let Mortgage Lenders makes significant changes to rental calculations and loan-to-values. The Mortgage Works has reacted to other Lenders by tightening its lending criteria. The biggest change is around … [Read more...] about The Mortgage Works changes rental calculation and maximum LTV for the worse

Buying the house next door with the help of a mortgage

Which Lenders will give me a mortgage if I want to buy the house next door property and rent it out. I get a surprisingly high number of mortgage enquiries relating to the purchase of buy-to-let properties that are next door to one already owned by … [Read more...] about Buying the house next door with the help of a mortgage

6 things to know about a Mortgage Agreement in Principle

Quick guide on getting a mortgage agreement in principle and the information that is required. This article provides generic information on the Mortgage Agreement in Principle process. I strongly advise that your first port of call, after reading … [Read more...] about 6 things to know about a Mortgage Agreement in Principle

Mortgage with maintenance payments

I want to get a Mortgage with maintenance payments as part of my income. How does it work? To get a mortgage with maintenance payments alone is not possible. If however, you or a fellow applicant has a job then the maintenance payments could … [Read more...] about Mortgage with maintenance payments

100% of rental income used for residential mortgage applications

Help the affordability of your residential mortgage by taking in your 100% of rental income on your buy to lets I want a residential mortgage, and although I work; I seek a Lender that will use 100% of rental income from my buy to let in their … [Read more...] about 100% of rental income used for residential mortgage applications

Mortgage with high childcare costs by ignoring nursery fees

Are there any mortgage lenders that will ignore nursery and child care fees in their affordability assessment? How can I get a Mortgage with high childcare costs I receive a constant stream of mortgage enquiries in regards to getting a Mortgage with … [Read more...] about Mortgage with high childcare costs by ignoring nursery fees

Getting a buy to let mortgage but have been away abroad in the last three years

I want to get a buy to let mortgage but have only been back in the UK for 12 months before that I was living and working abroad. Most buy to let mortgage lenders have got a ‘two or three year UK residency rule’ whereby they expect the applicants to … [Read more...] about Getting a buy to let mortgage but have been away abroad in the last three years

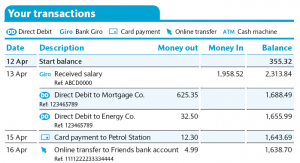

Bank Statements for Mortgage Applications

Best format for gathering your bank statements for Mortgage Applications including how to get statements with https:// on them. In our experience, one of the biggest causes of delay when gathering documentation for mortgage applications is … [Read more...] about Bank Statements for Mortgage Applications

95% mortgage for foreign nationals with a visa via the Help to Buy Scheme and Niche Advice

Foreign Nationals with a Visa and buy a £400,000 property in the UK with a £20,000 deposit Just a 5% deposit is needed to get a mortgage if you are a foreign nationals with a visa looking to purchase a UK property under the Help to Buy Scheme … [Read more...] about 95% mortgage for foreign nationals with a visa via the Help to Buy Scheme and Niche Advice

Can I Remortgage if I have a second charge Secured Loan

I have a second charge Secured Loan, can I still get a Remortgage if I still want the loan to remain in place. In theory if you have a second charge Secured Loan it does not prevent you from changing your existing first change mortgage for a better … [Read more...] about Can I Remortgage if I have a second charge Secured Loan

Let to Buy Mortgage Advice

Let to Buy Mortgage Advice when your looking to rent your current home often refinance to fund the purchase of another property. What is Let to Buy Mortgage and how does it all work. It is very common for clients to ask me about retaining their … [Read more...] about Let to Buy Mortgage Advice

Non SPV Limited Company Buy to Let Mortgage

Limited Company Buy to Let Mortgage options for Professional Landlords Since the budget the market has adjusted to provide more mortgage solutions for limited company purchases and remortgages. There is however an Important segment of the limited … [Read more...] about Non SPV Limited Company Buy to Let Mortgage