I’ve only been living and working here for a year in the UK and am on a Tier 2 Visa can I get a mortgage? The answer is ‘yes’, in theory, however, there are certain restrictions simply because of the time you’ve been in the UK and not necessarily … [Read more...] about Tier 2 Visa Mortgage Questions Answered

News

What is a Secured Loan?

What is a secured loan and how does it differ from a personal loan? A secured loan is essentially a second loan put behind a traditional first charge mortgage. The secured element comes from the right the lender will have to potentially repossessing … [Read more...] about What is a Secured Loan?

Secured loan with bad credit for Buy to Let Properties

Secured loan with bad credit may be an option if you need to raise extra equity from your Buy to Let properties. Over the last year I have spoken to many applicants who are existing landlords but were caught up with the recent financial crisis which … [Read more...] about Secured loan with bad credit for Buy to Let Properties

Secured loan with bad credit

If you’re looking at getting a secured loan with bad credit, I hope this article clarifies some of the key aspects on this type of product. A secured loan is essentially a second loan put behind a traditional first charge mortgage. The secured … [Read more...] about Secured loan with bad credit

Let to Buy Mortgage vs Buy to Let Mortgage

If you want to convert your existing property into an investment property, you will need a Let to Buy Mortgage A Let to Buy Mortgage is basically where the applicant wants to remortgage their existing residential property which will be let out to … [Read more...] about Let to Buy Mortgage vs Buy to Let Mortgage

Mortgages above five times income multiples

Great news for borrowers - another Lender has announced that they can now potentially offer Mortgages above five times income multiples We now have another Lender who has decided to join the ranks of Lenders who would potentially lend Mortgages … [Read more...] about Mortgages above five times income multiples

Mortgage for doctors, nurses and other NHS staff

Getting a mortgage if you are employed as a Surgeon, Doctor, Nurse, ambulance services or any other part of the National Health Service We are getting an increasing number of enquiries from applicants who work for the National Health Service who are … [Read more...] about Mortgage for doctors, nurses and other NHS staff

How can I get a Mortgage over five times salary

Can you still get you a mortgage over five times salary and if so what is needed The answer is “yes” but it depends on your personal circumstances but its not going to be easy to get a mortgage over five times salary. In short the maximum income … [Read more...] about How can I get a Mortgage over five times salary

Changes to the Family Buy to Let Mortgage product in the UK

Buy to Let Mortgages to rent to family members rules - Information on Regulated Buy to Let Mortgages If you want to buy a house and rent it to a family member such as your children (aged over 18 years), father, mother, brother sister, aunt and … [Read more...] about Changes to the Family Buy to Let Mortgage product in the UK

Mortgage Conveyancing explained

What does a Mortgage conveyancer /solicitor do when a property is purchased and how does this effect my house purchase chances? My role as a Mortgage Broker is to obtain finance to purchase a property requires me to keep you updated until the … [Read more...] about Mortgage Conveyancing explained

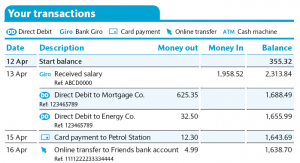

What do mortgage lenders look for in your bank statements?

If you are applying for a mortgage then the chances are the lender will want to see your bank statements, but why are these relevant? … [Read more...] about What do mortgage lenders look for in your bank statements?

Top 10 Mortgage valuation problems

Mortgage valuation problems & what property defects are mortgage lenders looking for in their valuation? When you are arranging a mortgage the lender will carry out a basic mortgage valuation. This article covers the Top 10 Mortgage … [Read more...] about Top 10 Mortgage valuation problems

What documents do I need to get a Residential Mortgage?

In this post I will try to clarify what documents are needed in order for you to get a mortgage. Please can I start by stating that since the FCA Mortgage Market Review (MMR), the level of documentation required by the lenders as well as brokers has … [Read more...] about What documents do I need to get a Residential Mortgage?

Mortgage with a criminal record

Tips on getting a Mortgage with a criminal record and how to source the right mortgage in the UK if you have been to prison. I am a firm believer that people who have paid their price should always be given a second chance. Unfortunately this may … [Read more...] about Mortgage with a criminal record

Why its time to Remortgage to a fixed rate

5 year Fixed Mortgage rates from 2.44% maybe its time to Remortgage to a fixed rate now In recent years remortgages have not been as popular as they once were as rates have been so low, however both the Chancellor and Governor of the Bank of England … [Read more...] about Why its time to Remortgage to a fixed rate